Similar to EPF SOCSO contribution will be deducted from both employees and employers funds and will be paid every 15th of each month. A person who has attained 58 years of age has resigned retired from services of a company and has taked full and final settlement of his PF dues from his previous employer is an excluded employee.

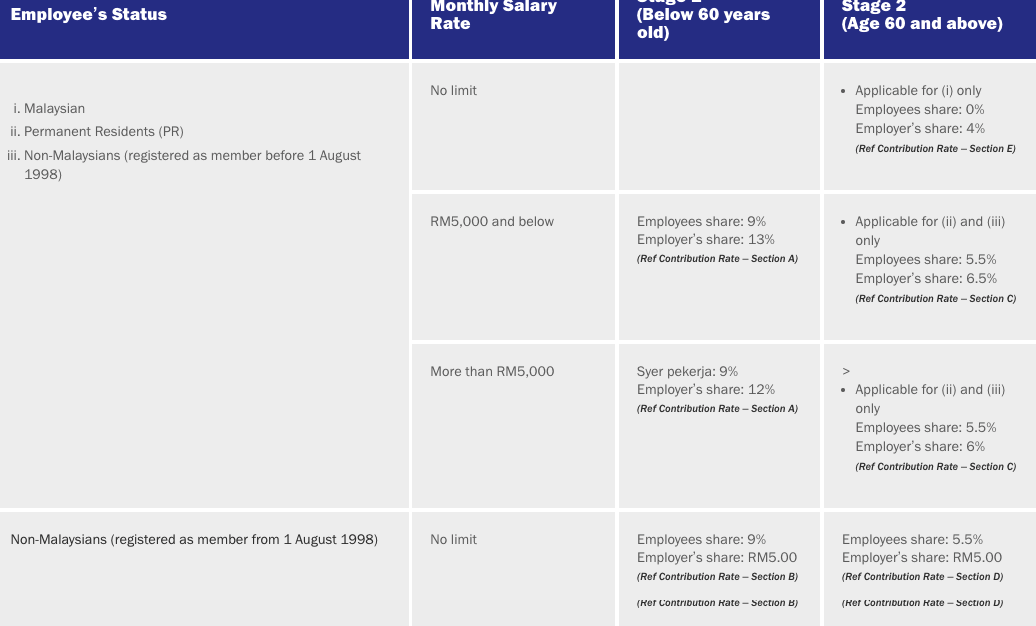

Epf Reduces Minimum Contribution For Employees Above Age 60 To 4 Per Cent

Malaysias 2021 budget announcement has highlighted that the EPF rate for employee under the age 60 years old is reduced from 11 to 6 by default with effect from February 2021 to January 2022.

. If he joins any establishment he will not come under the purview of PF Act. 7th October 2009 From India Calcutta.

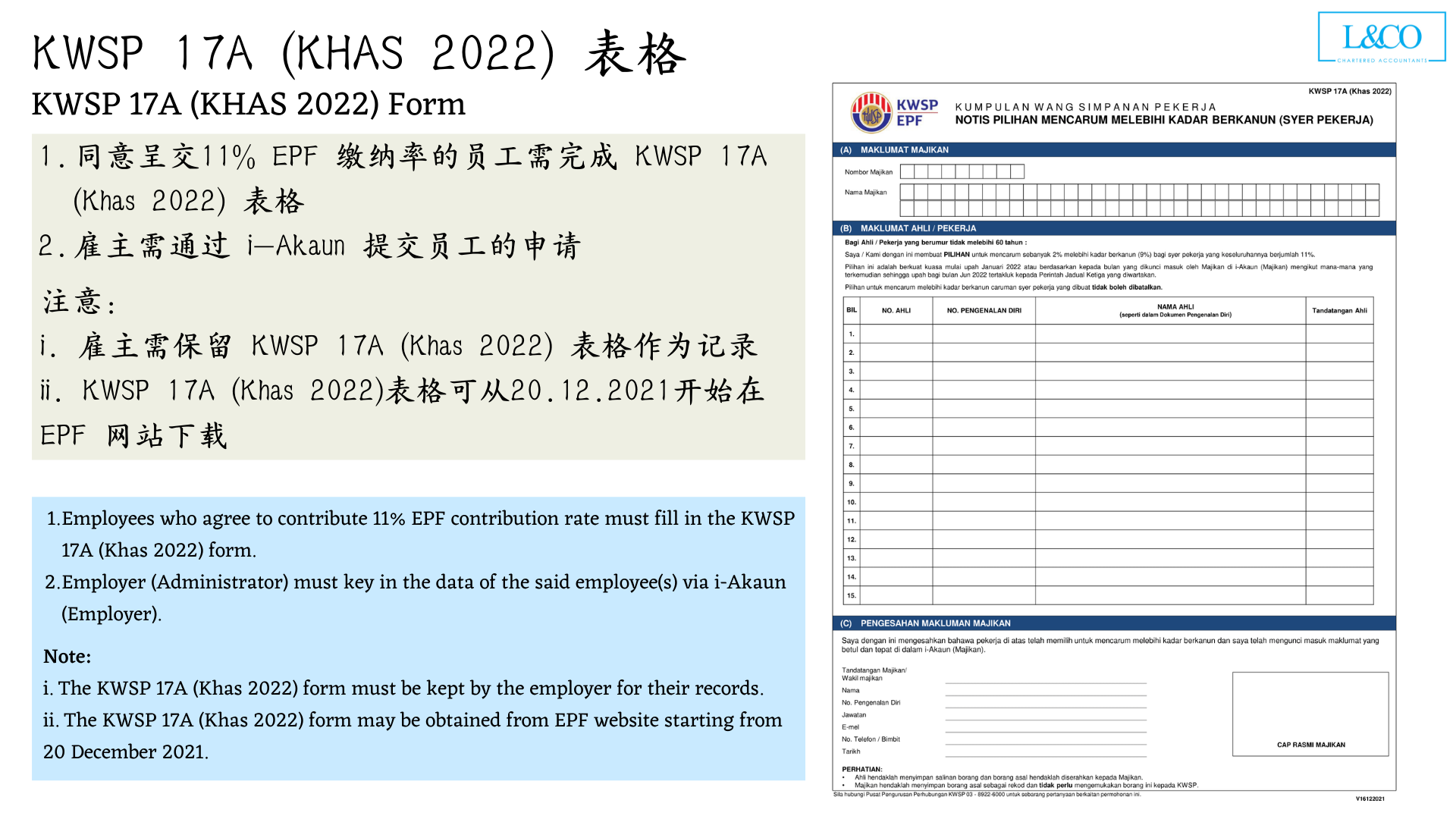

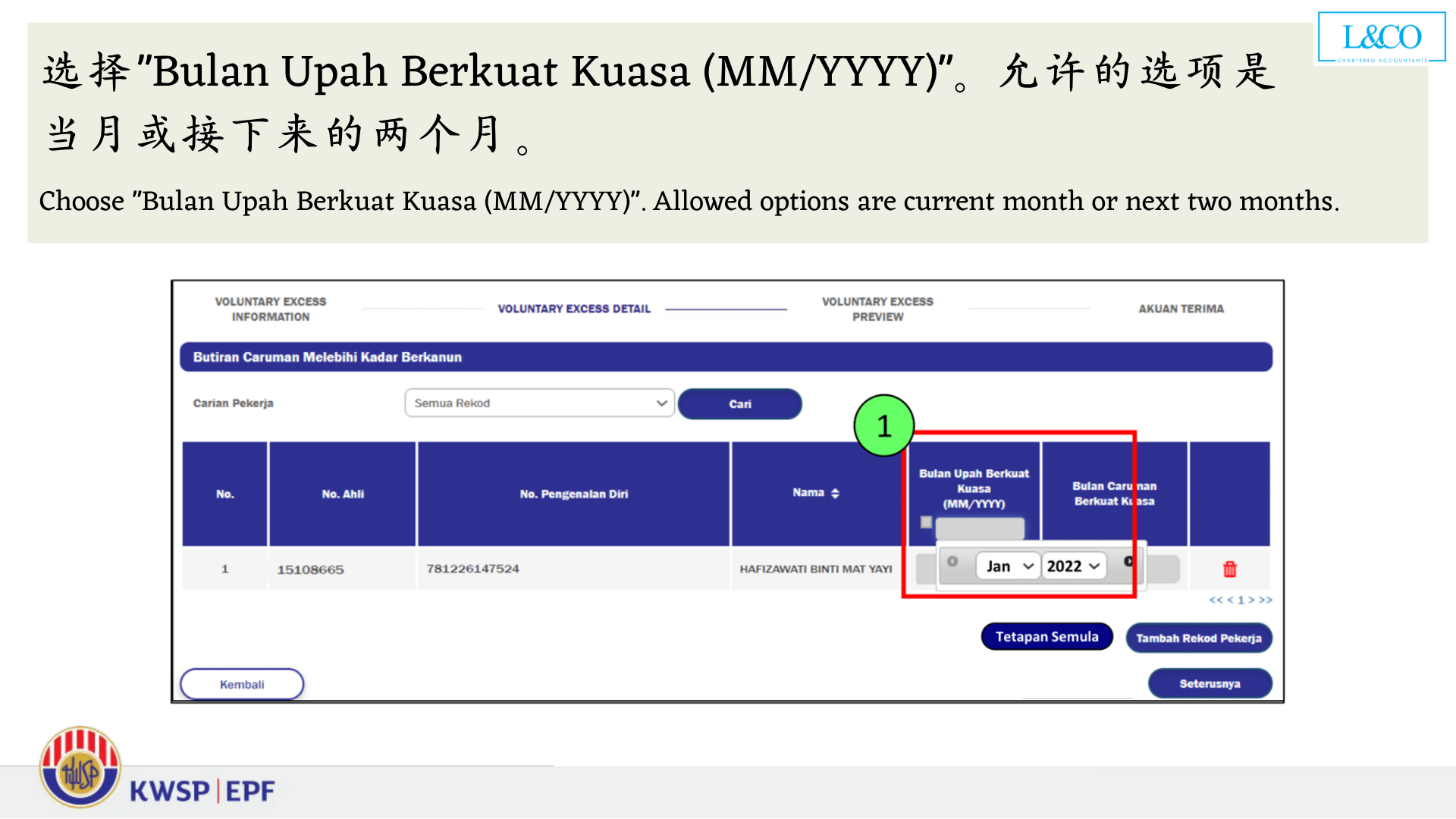

Steps To Apply Employee S Epf Contribution Rate At 11

Epf Contribution For Employee Age Above 60 Blog

Epfo Government Of India Will Pay The Epf Contribution Of Both Employer And Employee 12 Each For The Next Three Months So That Nobody Suffers Due To Loss Of Continuity In

Steps To Apply Employee S Epf Contribution Rate At 11

Employee Provident Fund Epf Changed Rules From 1st Sept 2014 Sap Blogs

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Zero Epf Contribution For Above 60 Year Old Workers

Employee Epf Contribution Rate Reduced Form 12 To 10 Workforce Blog

Epf Contribution Rates 1952 2009 Download Table

How Epf Employees Provident Fund Interest Is Calculated

Steps To Apply Employee S Epf Contribution Rate At 11

Epf Contribution Reduced From 12 To 10 For Three Months

Basics And Contribution Rate Of Epf Eps Edli Calculation

Epf New Employee Minimum Statutory Contribution Rate On Ya2021 Yau Co